Within the last decade, the percentage of floor space occupied by operators of food and beverage (F&B) outlets in shopping centers has increased from 7% to 15%.

According to JLL, the trend is far from over, with a predicted increase to at least 20% over the next decade.

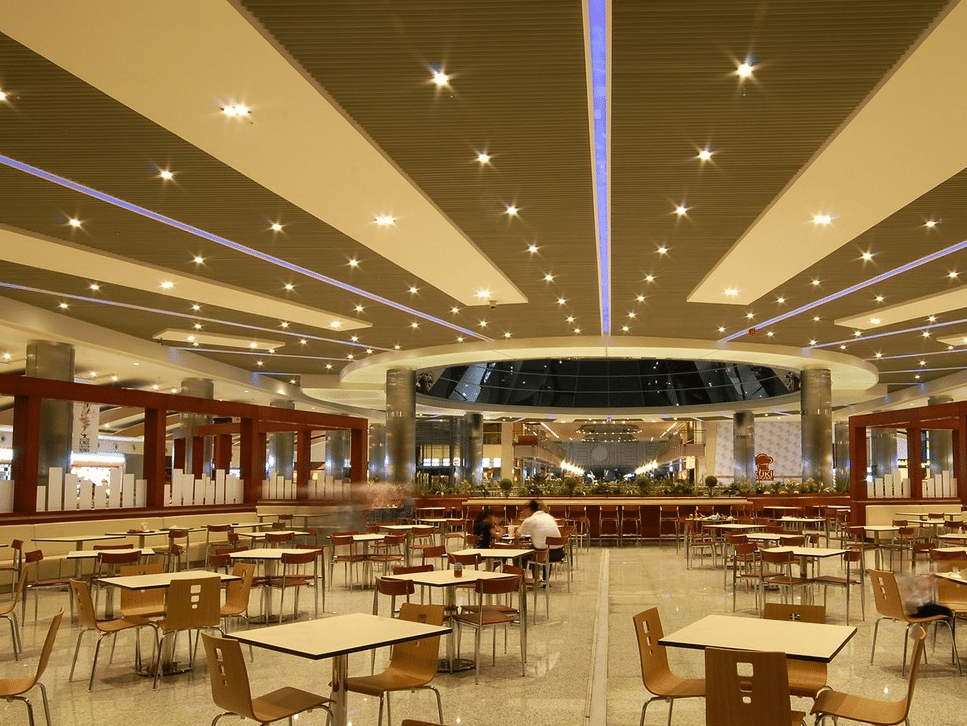

Eating is the new shopping. Experts now acknowledge that food is a pillar factor to encouraging dwell time in malls. And there are stats to back this position. Detailed research into spending and dwell time of customers project that on average, customers who eat while visiting the shopping center would spend 18% more in overall transactions, and stay for an extra 27 minutes across the shopping center.

Propelling the sharp growth of F&B in retail is the quest for new experiences amongst shoppers and ‘gourmetization.’ In addition, the rising number of visitors and tourists from China and other Asian markets will drive demand for more food operators, particularly Asian food operators.

For example, in the UK, the recent relaxation of visa requirements will likely increase tourism and cause more Chinese travelers to visit. Already, a high-value Japanese noodle chain—Ippudo—has set up shop in London, lending voice to the notion that there is rising demand for Asian food.

According to the MD of Coverpoint, JLL’s consulting business, Jonathan Doughty, the trend is cemented by the fact that online sales are on the rise and it is currently impossible to gain leisure and culinary experiences from online platforms. This is the exclusive preserve of brick-and-mortar retail spaces.

As a result, city markets that are able to deliver complementary and well-configured dining and drinking provision will add vitality and diversity to boost shopping experience and dwell time. When this is well orchestrated, it makes for an awesome reason for consumers to “keep coming back.” In his words, “this is only set to rise.”

The trend does offer an interesting opportunity for retailers, outlet owners, and investors. According to Robert Bonwell, a senior executive at JLL, restaurants and food offerings should maximally exploit the growing eating and leisure trends.

Digging deeper into the eccentricities of the trend uncovers interesting information. First off, the key factor causing the growth in the F&B sector is referred to as gourmetization. Basically, it refers to the desire of customers to indulge in a plush, rich dining experience: in simpler terms, enriching the quality and delivery of a basic product.

Another factor is the emerging trend for hybrid food: combining two basic products to create something new that arouse interest. A poster child of this concept is the restaurant, Sushi Samba, offering a hybrid of Peruvian, Japanese and Brazilian food. ‘Cronut’ is a hybrid food that is the combination of a doughnut and a croissant. It is offered by Rinkoff bakery.

The third major factor is offering an exciting mix of services. Restaurants that offer a mix of service and self-service are redefining the modern F&B landscape. An increasingly popular example of this offering is increased self-service in mass-market dining. A solid pillar for high quality delivery of this custom service format is for the F&B brand to have staff that demonstrate increased level of engagement, prowess and knowledge. A prime example of a brand offering this is Vapiano.

McDonald's quarterly revenue rose to $5.9 billion from $5.67 billion a year earlier.

SES is setting new standards with Zagreb’s KING CROSS shopping center.

In 2025, retail expansion stopped being about square meters and started being about intent. Across luxury, athleisure and digital-native brands,…

Central Pattana unveils The Central, a new US$575m mall in Bangkok’s fast-growing northern district with a planned opening in late…

Singles’ Day 2025 breaks new global records with $150B+ in sales. Discover the top categories, data insights, and retail trends…

MixC Shenzhen Bay opens in Shenzhen’s Nanshan district, blending luxury retail, art, and lifestyle into one destination, redefining the Asian…